Diamond and Jewellery

Armoured Service

We provide domestic transportation of D&J (Diamond & Jewellery) across the supply chain. The movement covers dispatch of raw material for production, collection of finished products from suppliers, inter-warehouse transfers, delivery to retail stores and returns management. We fully understand the “value of time” and its impact on our customer’s working capital and order commitments. Thus, we deliver shipments in an extremely short turnaround time.

E-commerce

From API integration to cash-on-delivery and return movements, we offer robust, all-round services for all your e-commerce requirements and cover a gamut of B2C services for you.

Exhibitions

Date: 23rd to 25th May 2025

HILS

Hyderabad International Jewellery Show

HILS

Hyderabad International Jewellery Show

Date: 06th to 09th June 2025

Silver Show of India

Jio World Convention Center Bandra Kurla Complex - Mumbai

Silver Show of India

Jio World Convention Center Bandra Kurla Complex - Mumbai

Date: 10th to 12th June 2025

PMI

Preferred Manufacturer

of India

PMI

Preferred Manufacturer

of India

Date: 04th to 07th Apr 2025

INDIA GEM & JEWELLERY SHOW

Jio World Convention Center

INDIA GEM & JEWELLERY SHOW

Jio World Convention Center

Date: 21st to 24th Mar 2025

IIJS Tritiya

BIEC, Bengaluru

IIJS Tritiya

BIEC, Bengaluru

Date: 09th to 11th Mar 2025

SSVASS 2025 Varanasi

Hotel Surya Kaiser

SSVASS 2025 Varanasi

Hotel Surya Kaiser

Date: 08th to 09th Mar 2025

GJE- Bhuj

Bhuj, Gujarat

GJE- Bhuj

Bhuj, Gujarat

Date: 04th to 05th Jan 2025

Swayamwar

SKY Mall , Morbi

Swayamwar

SKY Mall , Morbi

Date: 13th to 14th Jan 2025

Aabhushan Utsav

Hotel Babylon International , Raipur

Aabhushan Utsav

Hotel Babylon International , Raipur

Date: 31st to 02nd Jan 2025

GJE Rajkot

Ratna Vilas Palace, Rajkot

GJE Rajkot

Ratna Vilas Palace, Rajkot

Date: 28th to 02nd Feb 2025

GJIIF Chennai

Chennai Trade Center, Chennai

GJIIF Chennai

Chennai Trade Center, Chennai

Date: 01st to 02nd Mar 2025

SGJS Surat

Surat International Exhibition and Convention Center, Sarsana, Surat

SGJS Surat

Surat International Exhibition and Convention Center, Sarsana, Surat

Date: 01st to 02nd Mar 2025

AJE-2025

Guwahat

AJE-2025

Guwahat

Query on Serviceability and Turn Around Time

Documentation and Packaging for Domestic Secure Logistics Movement

Domestic Movement - Sale and Inter-Company Transfer

1. For normal domestic movements involving the sale and inter-company transfer (stock transfer), a GST invoice is mandatory as per the GST law. Necessary details to be mentioned in the GST invoice (GST number of both sender and receiver, HSN code, material description, net weight (weight of gold or silver), gross weight (including stones), type of GST and percentage of GST applicable, value before and after adding GST)

a. E-invoice should be given if the turnover is above Rs. 5.00 crores (3 copies including receiver’s copy and transporter’s copy)

2. Packing manifest which includes box to item mapping

3. Logistics document (docket copy)

Domestic Movement - Marketing and Repairing Purposes

1. GST Delivery Challan (Sender’s GST number, HSN code, material description, net weight, gross weight and value) – Download GST Delivery Challan Template

a. 3 copies including the receiver’s copy and transporter’s copy

2. Travel Itinerary

3. Logistics document (docket copy)

Domestic Movement - Exhibitions

1. 1. GST Delivery Challan (Sender’s GST number, HSN code, material description, net weight, gross weight and value) – Download GST Delivery Challan Template

a. 3 copies including the receiver’s copy and transporter’s copy

2. Logistics document (docket copy)

3. Authorization letter

4. Participation letter

Packaging

Jewellery is delicate and prone to damage. To avoid damages in transit and to enhance security, the jewellery should be packed in sturdy boxes with tamper-proof packaging. Please follow the points mentioned below.

- 1. Jewellery should always be packed in steel boxes

- 2. Seal the box with one time seals (secure pouches or one time locks without duplicity)

- 3. Ensure proper cushioning inside the box and around the jewellery so that there are no empty spaces (Download Guide – Packaging of Bangles)

Modes of International Movement

Cargo Mode

To deliver high value & heavy shipments. After customs clearance, shipment is booked

on an airline to the destination airport. At destination airport, our partner will take care of

the customs clearance and the delivery process.

Courier Mode

To deliver small value & light shipments. After customs clearance, shipment is booked

on Fedex/UPS for door-to-door service.

Armoured Service

We provide international transportation of D&J (Diamond & Jewellery) across the supply chain. The movement covers dispatch of raw material for production, collection of finished products from suppliers, inter-warehouse transfers, delivery to retail stores and returns management. We fully understand the “value of time” and its impact on our customer’s working capital and order commitments. Thus, we deliver shipments in an extremely short turnaround time.

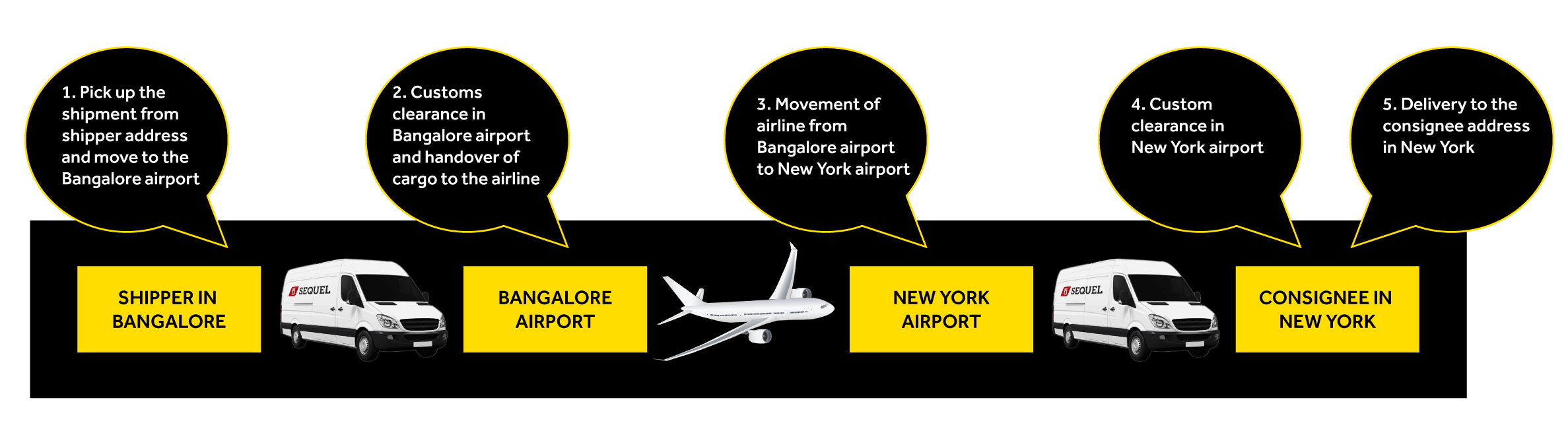

Export Process

Consider a shipper in Bangalore wants to send a consignment to his consignee in New York through cargo mode.

*For illustration purposes.

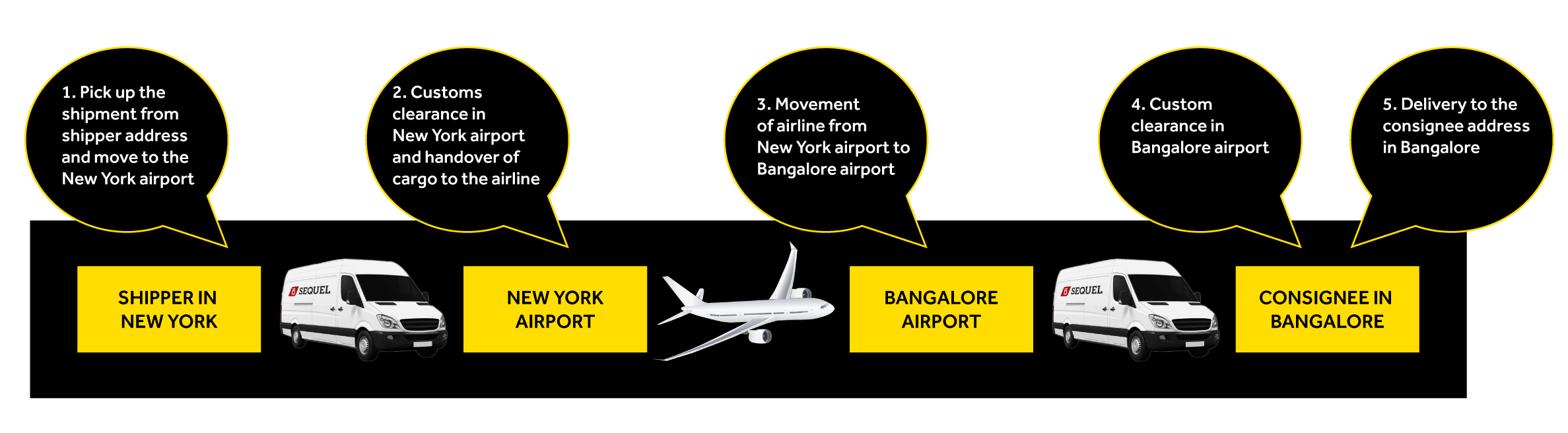

Import Process

Consider a shipper in New York wants to send a consignment to his consignee in Bangalore through cargo mode.

*For illustration purposes.

The commodities imported can be:

- Freely importable

- Restricted

- Banned

Indian Trade Classification (ITC)

Indian Trade Classification (ITC) are based on Harmonized System (HS) of coding. It was adopted in India for

import-export operations. Indian customs uses an eight-digit ITC (HS) code to suit the national trade

requirements. Duties are applicable based on the classification of commodities (ITC).

Types of BOE (Bill of Entry)

- Freely importable

- Restricted

- Banned

Stakeholders

1Shipper/Seller in Bangalore

- Should have mandatory documents like IEC & AD code and must be registered with the customs

- Must provide the cargo duly packed for export along with the invoice and packing list for the shipment

- Will also confirm who will pay for the logistics charges and the service availed (Door to Airport, Door to Door)

2 Freight-forwarder in Bangalore (Sequel Logistics Pvt. Ltd.)

- Responsible for pickup of the cargo from the shipper’s place

- Booking the shipment with the airline and handing over the documents and cargo to airline after clearance

- Sending the pre-alert documents to overseas counterpart

- Airline payment

- Will arrange insurance cover on request

3 Customs Clearance Agent in Bangalore (CHA)

- Has license for clearing the cargo with customs

- Filing the shipping bill with customs

- The shipping bill are of four types: Free, Dutiable, Drawback, Ex-bond

- Will be responsible for the examination and clearance (the shipper will be required to be present during the clearance) of the cargo

- Will help to settle any queries raised by customs

4 Customs official in Bangalore Airport

- The authority to approve the export lies with customs official

- The declaration done to the customs must be accurate to avoid any query and shipment delays

5 Airline to carry the shipment from Bangalore to New York Airport

- Will carry the cargo to the destination as booked by freight forwarder

- Boxes with valuables should be readily available

- Airlines work under the framework of IATA (The International Air Transport Association)

- Airlines must follow the rules of DGCA in India

- The goods will be carried as Direct shipment or Consol shipment

- Cargo carried in freighter or in passenger plane

6 Freight Forwarder in New York (Loomis International, USA)

- Collects the shipment documents from the airline

- Will inform the consignee and release the documents to consignee nominated customs agent

- Deliver the shipment to consignee if requested

7 The Custom Clearance Agent in New York

- Filing the custom entry in New York on behalf of the consignee

- Informing the duty/tax to be paid to consignee

- Clearing the shipment for the consignee after duty/tax payment

- Will help in solving any issues with customs

8 Custom official in New York

- Will examine the cargo

- Will check if the duty/tax is properly calculated

- Will give approval for import if the regulations are followed and duty/tax is paid by the consignee

9 Consignee/Buyer in New York

- Should have required registration in USA

- Will provide the docs as requested by customs agent in New York

- Will pay the duty/tax for the shipment to US customs

- Accept the delivery of the cargo

E-commerce

Door delivery services for end consumers shall be done through courier mode. From API integration to cash-on-delivery and return movements, we offer robust, all-round services for all your e-commerce requirements and cover a gamut of B2C services for you.

Exhibitions

Date: 08th to 10th October 2024

INTERNATIONAL GEM AND JEWELLERY SHOW

DUBAI

INTERNATIONAL GEM AND JEWELLERY SHOW

DUBAI

Date: 18th to 20th Sep 2024

Jewellery & Gem World Hong Kong

Hong Kong

Jewellery & Gem World Hong Kong

Hong Kong

Date: 30th May to 03th Jul 2024

JCK Las Vegas

Las Vegas USA

JCK Las Vegas

Las Vegas USA

Date: 17th to 20th Apr 2024

Istanbul Jewellery Show

Istanbul

Istanbul Jewellery Show

Istanbul

Date: 27th Feb to 01st Mar 2024

Hong Kong international Jewellery

Hong Kong

Hong Kong international Jewellery

Hong Kong

Date: 19th to 23rd Jan 2024

Vicenzaoro

Italy

Vicenzaoro

Italy

Date: 14th to 18th Nov 2023

Jewellery Arabia, Bahrain

Bahrain

Jewellery Arabia, Bahrain

Bahrain

Date: 06th to 10th Sep 2023

Bangkok Gems & Jewellery Fair

QSNCC, Bangkok

Bangkok Gems & Jewellery Fair

QSNCC, Bangkok

Date: 01st to 05th Jun 2023

JCK Las Vegas

The Venetian, Las Vegas

JCK Las Vegas

The Venetian, Las Vegas

Date: 20th to 24th Jan 2023

Vicenzaoro

Vicenza, Italy

Vicenzaoro

Vicenza, Italy

Date: 22th to 26th Feb 2023

Thailand Gems & Jewellery Fair

Impact Challenger Bangkok

Thailand Gems & Jewellery Fair

Impact Challenger Bangkok

Date: 01st to 05th Mar 2023

HKTDC AsiaWorld - Expo &

Convention Center Hong Kong

HKTDC AsiaWorld - Expo &

Convention Center Hong Kong

Date: 12th to 14th Feb 2023

JGT Dubai

Dubai World Trade Center

JGT Dubai

Dubai World Trade Center

Date: 26th to 30th Oct 2022

JWS Abu Dhabi, UAE

JWS Abu Dhabi, UAE

Date: 01st to 04th Oct 2022

Intergem (IDAR-OBERSTEIN - DE)

Intergem (IDAR-OBERSTEIN - DE)

Date: 15th to 19th Sep 2022

UBM Hong Kong Jewelry & Gem Fair

UBM Hong Kong Jewelry & Gem Fair

Date: 6th to 10th Sep 2022

Armoury New York 2022

Armoury New York 2022

Date: 01th to 03th Aug 2022

Diggers and Dealers, Kalgoorlie

Diggers and Dealers, Kalgoorlie

Date: 08th to 11th Jul 2022

Singapore International Expo

Singapore International Expo

Date: 16th to 19th Jun 2022

UBM ASIA Hong Kong

UBM ASIA Hong Kong

Date: 16th to 19th Jun 2022

Art Basel Switzerland 2022

Art Basel Switzerland 2022

Date: 12th to 15th Jun 2022

IPMI - San Antonio

IPMI - San Antonio

Date: 10th to 13th Jun 2022

G.L.D.A. Las Vegas

G.L.D.A. Las Vegas

Date: 10th to 13th Jun 2022

JCK Las Vegas

JCK Las Vegas

Date: 09th to 12th Jun 2022

Couture Show Las Vegas

Couture Show Las Vegas

Date: 08th to 09th Jun 2022

Luxury Las Vegas

Luxury Las Vegas

Date: 06th to 12th Jun 2022

IPMI - San Antonio

IPMI - San Antonio

Date: 26th to 28th May 2022

IJK- International Jewellery Kobe

IJK- International Jewellery Kobe

Date: 18th to 22th May 2022

Frieze New York 2022

Frieze New York 2022

Date: 09th to 12th May 2022

African Mining Indaba, Cape Town

African Mining Indaba, Cape Town

Date: 15th to 18th Apr 2022

Jewellery Festival, KL

Jewellery Festival, KL

Date: 6th to 10th Apr 2022

Baselworld, Switzerland

Baselworld, Switzerland

Date: 01st to 04th Apr 2022

Baselworld, Switzerland

Baselworld, Switzerland

Date: 31st Mar 2022

Baselworld, Switzerland

Baselworld, Switzerland

Date: 24th to 27th Mar 2022

Istanbul Jewellery Show

Istanbul Jewellery Show

Date: 22th to 26th Mar 2022

Art Central Hong Kong

Art Central Hong Kong

Date: 16th to 19th Mar 2022

Art Dubai

Art Dubai

Date: 12th to 20th Mar 2022

TEFAF Maastricht, Netherlands

TEFAF Maastricht, Netherlands

Date: 07th to 10th Mar 2022

PDAC Conference, Toronto

PDAC Conference, Toronto

Date: 03rd to 08th Mar 2022

HKTDC Jewellery Show

HKTDC Jewellery Show

Date: 01st to 05th Mar 2022

HKTDC, Gem & Pearl Show

HKTDC, Gem & Pearl Show

Date: 12th to 15th Feb 2022

Bangkok Gem & Jewellery Fair

Bangkok Gem & Jewellery Fair

Date: 12th to 15th Feb 2022

Japan Jewellery Fair, Tokyo

Japan Jewellery Fair, Tokyo

Date: 11th to 14th Feb 2022

Inhorgenta Munich, Germany

Inhorgenta Munich, Germany

Date: 03rd to 06th Feb 2022

JCK Tucson

JCK Tucson

Date: 01st to 06th Feb 2022

AGTA Las Vegas

AGTA Las Vegas

Date: 01st to 06th Feb 2022

GJX Gem & Jewelry Exchange Tucson

GJX Gem & Jewelry Exchange Tucson

Date: 01st to 06th Feb 2022

JOGS Tucson Gem & Jewelry Show

JOGS Tucson Gem & Jewelry Show

Date: 26th to 31st Jan 2022

JOGS Tucson Gem & Jewelry Show

JOGS Tucson Gem & Jewelry Show

Date: 21st to 26th Jan 2022

Vicenzaoro, Vincenza

Vicenzaoro, Vincenza

Date: 12th to 15th Jan 2022

Tokyo

Tokyo

Network

- Operations across 130+ countries

- Comprehensive liability coverage

- Insured small value parcel service to 97 countries

- Trade show services

Priority Delivery

- Antwerp

- Bahrain

- Doha

- Dubai

- Kuwait

- Oman

- Sharjah

- Paris

- Frankfurt

- Hong Kong

- Shanghai

- Vicenza

- Tokyo

- Kuala Lumpur

- Singapore

- Basel

- Geneva

- Zurich

- Bangkok

- Istanbul

- London

- New York

Types of Cargo

Gold Jewellery and Articles

Silver Jewellery and Articles

Diamonds

Gemstones

Platinum Jewellery

Industrial Platinum

Foreign Currency

Smart card

Documentation and Packaging

Documentation

The shipper needs to be registered with the customs authorities for export from India.

The documents required for export

- Invoice

- Packing list

- Certificate of origin

Packaging

The cargo must be packed in a sturdy metal box with strong locks.