Free trade warehousing zones are strategically located premises treated as international

zones which enable the trading and storage of goods on behalf of foreign or domestic clients.

FTWZ provides efficient connectivity via road, rail, air, and sea. Within the geography of India,

it acts as a deemed foreign territory.

Free Trade Warehousing Zones in India fall under Special Economic Zones Act, 2005, and the

Special Economic Zones Rules, 2006. The Ministry of Commerce and Industries is involved in

clarifying various operational aspects of FTWZ.

Benefits of a Free Trade Warehousing Zone

- Service tax exemption

- Deferred customs duty payment

- Benefits of export when transferring goods from Domestic Tariff Area (DTA) to FTWZ

- Hassle-free re-export, re-sale, and re-invoice of goods

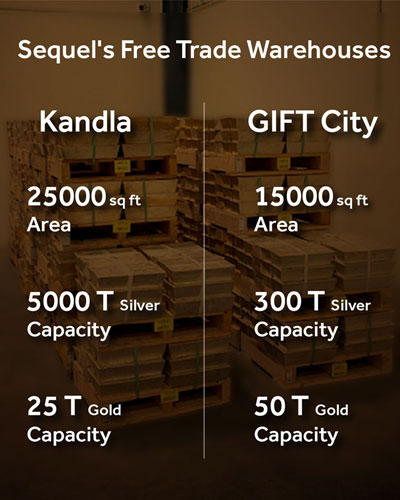

Sequel’s facilities at Kandla and Gift City - Gateways for Import and Long-Term

Storage of Bullion

Sequel has precious commodities storage facilities at two Free Trade Warehousing Zones

(Kandla and GIFT City) in India. Both facilities are audited and approved by most major

international suppliers for precious metal storage and are strategically positioned in such a

way as to cater to the major precious metals manufacturing units in Gujarat, Rajasthan,

Maharashtra, Agra, and Uttar Pradesh. Sequel’s free trade warehouses are utilized by major

international banks, financial institutions, manufacturing units, traders, and suppliers. These

warehouses are specially designed to handle precious commodities and to facilitate

international trade of bullion.

The centrally and locally monitored facility of Sequel enables the hassle-free handling of precious commodities with world-class physical and electronic security. Sequel offers prompt delivery to all metros and large cities from the warehouses at Kandla

and GIFT City.

How Sequel adds value to bullion trading through its two Free Trade Warehousing Zones

- Long term storage of imported goods

- Insulated from duty fluctuations

- Provision to store both gold and silver

- Located at IFSC – GIFT City

- Efficient inventory management

- Geographical proximity to important manufacturing hubs

- Connectivity to major cities via different modes of transportation

- Strategic partnerships with International Logistics Companies

- Lower total transaction and transportation cost

- Duty exemption on re-export